News + Insights

- Learn

Working out the true reason for a plateau is the first step. The next is knowing how to correct it.

- Learn

Family businesses are unlike any other business structure. Without the right support, important conversations can stall, escalate or be avoided altogether – often at the expense of the business and the family.

- Events

Our final Success Stories Breakfast for 2025 explored the importance of succession planning when preparing to hand over leadership to the next generation

- Learn

Whether you're aiming for growth, stability or transition, the start of the year is a natural point to establish the priorities that will guide your next phase of success.

- Learn

The Christmas period can be unpredictable for businesses. Our tips ensure delayed payments, staff leave, and additional expenses don't impact your business.

- Events

Matthews Steer Partner Damian James recently presented at a NORTH Link event - read more for the key insights.

- Learn

How will working with our advisors help build performance and profit? The Matthews Steer Catalyst Program turns advice into action.

- Learn

Even if you don’t intend to leave your business soon, an Exit Plan creates valuable clarity about your long-term goals. Here's how they help you secure your future.

- News

Round Three of the Industrial Transformation Stream is now open, providing a total of $180 million in funding to support industrial facilities in regional Australia that are working towards decarbonisation.

- Learn

How do you achieve long-term, stable growth? With the right expertise and insights you can future-proof your business and create a business that thrives.

- Learn

Tailored Virtual CFO services give your business expert financial guidance without the cost of a full-time hire. Here’s when you should consider engaging a vCFO and the benefits of doing so.

- Learn

Matthews Steer Business Advisors help you act early, explore options, and put the right structures in place to move forward with confidence.

- Events

Designed to educate, inspire and connect, these events feature guest speakers who share their journeys of growth and success.

- Learn

From startups to established businesses, we can help identify and secure government funding to support your growth plans

- News

Significant updates with the introduction of a new online form that places greater emphasis on reporting, documentation, and financial transparency.

- Learn

Without the right planning, succession can create conflict, tax complications, and even risk the survival of the business itself.

- Learn

A strong, well-considered plan can give you confidence, clarity, and direction in times of change.

- Learn

Thinking about the future of your business doesn’t mean stepping back, it means stepping up to protect what you’ve built.

- Learn

We’re excited to launch our new corporate video. A one-minute glimpse into the heart of who we are.

- Learn

We believe that building a secure financial future isn’t about waiting for the “right time”, it’s about starting now, with the right guidance.

- Events

Congratulations to Grace Wimalasekera! Our 2025 Employee of the Year was announced at our annual RER awards night alongside other award winners.

- Learn

Practical, proactive measures that businesses can implement to reduce their exposure and prevent becoming a victim of fraud.

- Learn

It's easy to confuse being busy with being successful. If you’re not tracking the right numbers you’re likely losing money without realising.

- Events

What does it take for family businesses to thrive in a fast-evolving world?

- News

This recognition is more than a badge - it’s a reflection of our culture, values, and the incredible team that brings it all to life every day.

- Events

Hosted by our Vibe Club, it was a true reflection of our strong community spirit with delicious contributions coming from team members across the business.

- News

From 1 July ATO GIC and SIC charges will no longer be tax-deductible. Now is the time to review your strategy and prepare to ensure you're not impacted.

- Events

Success Stories Breakfast with That’s Amore Cheese owner and founder, Giorgio Linguani, and CEO, Marco Alghisi.

- News

If you control a family trust that distributes to a private company the outcome of this case could impact you.

- News

From 1 January 2025 significant changes will take effect, expanding the scope statewide and altering the tax structure.

- Events

It was a wonderful way to conclude our 2025 Success Stories Breakfast events with Susan Alberti joining us to share her story of triumph in the face of adversity.

- News

Beginning with the 2023-24 income year, non-charitable Not For Profit (NFP) organisations with an active ABN are required to lodge an annual NFP self-review return to self-assess their income tax exemption.

- News

For the first time in three years, both the concessional and non-concessional caps will increase on 1 July 2024.

- News

What do we know about ATO private group tax reviews and what steps can be taken to ensure you are prepared when the time comes.

- Learn

The lead-up to the EOFY can be a good time to review your financial situation and consider how to take advantage of the available tax concessions on super contributions. These super and tax strategies could maximise your retirement savings and legitimately minimise your tax bill.

- Events

Join our Head of Grants & Innovation, Dr Richard Wraith on a free webinar with Melbourne’s North Food Group as he delves into the current funding available to food manufacturing businesses, including Austrade’s Export Market Development Grants, the R&D tax incentive and the recently announced Future Made in Australia Act.

- Events

Bertocchi Chairman, Tony De Domenico OAM, joined us to share his experience of working with the leading manufacturer of continental smallgoods in Australia.

- News

Having helped many of our clients prepare for and execute a sale these are the 7 key steps that we know pave the way for the best outcome.

- News

The ATO is now taking a stricter approach for overdue business tax debts or outstanding lodgments.

- News

Grant applications now closed. The Victorian Government released two new business grants – 1. Made in Victoria – Manufacturing Growth Program. 2. Made in Victoria – Energy Technologies Manufacturing Program.

- News

Matthews Steer is thrilled to announce our gold sponsorship at the Victorian Manufacturing Showcase 2023.

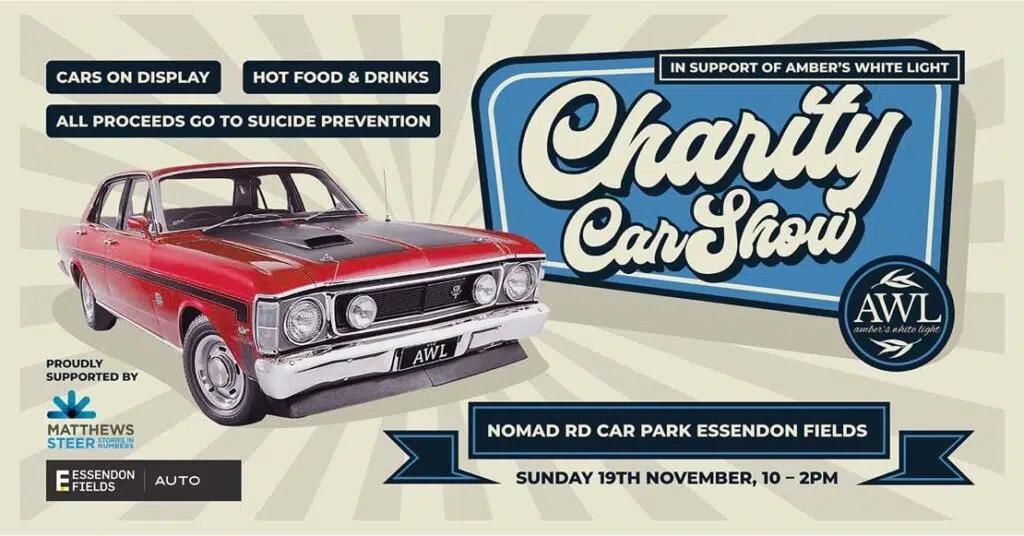

- News

Charity Car Show on Sunday November 19th to support Amber's White Light, who advocate for and fund research into prevention of youth mental health and suicide.

- News

Gareth Hearnden from Norman Carriers joined us for another morning of great discussion and the hospitality Matthews Steer are known for.

- News

Among the many celebrations at our recent RER (Recognise Encourage Reward) Awards we marked the retirement of Liz Matthews, our marketing coordinator.

- News

It’s surprising how many people think that because they’ve written their will, the job of estate planning is complete. Estate planning is so much more than just a will. It’s the process of putting your affairs in order now, to ensure your estate is managed efficiently, as you intend it, in the case mental impairment and, ultimately, death.

- News

Anthony Seneca has been named Matthews Steer’s employee of the year at the firm’s annual Recognise, Encourage, Reward (RER) Awards, held at the RACV Club Melbourne on July 21.

- News

Matthews Steer Accountants and Advisors is pleased announce the promotion of Richard Wraith from Senior Principal, Innovation and Grants, to Partner. Richard has been instrumental in leading and professionally developing Matthews Steer’s Innovation and Grants team and expanding and evolving the firm’s government grants advisory offering.

- News

R&D Tax Incentive registrations for FY22 closed on April 30 so, with the end of the financial year approaching, now is the perfect time for early-stage companies to get their R&D Tax Incentive claims prepared.